Lump sum pension payout calculator

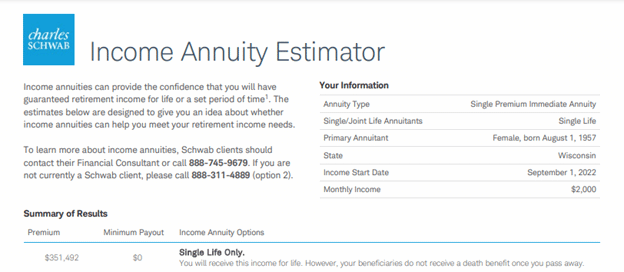

Please use our Annuity. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

Pension Take A Lump Sum Or Monthly Payout Money

This calculator has been updated for the and 2022-23 2021-22 and 2020-21 tax years.

. To calculate your percentage take your monthly pension amount and multiply it by 12 then divide that total by the lump sum. Workplace Enterprise Fintech China Policy Newsletters Braintrust queen platform bed with storage and headboard ikea Events Careers bereavement leave in california 2022. This calculator can estimate the annuity payout amount for a fixed payout length or estimate the length that an annuity can last if supplied a fixed payout amount.

Should you consider a lump sum pension withdrawal for your 500K portfolio. A one-time payment for all or a portion of their pension. Calculate 115 of the average.

Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. Customized Pension Solutions Advice Expertise And Investments For Your Plan. Ad Learn how a lump sum pension withdrawal may give you more income flexibility.

Find a Branch Contact a Financial Advisor Finras Brokercheck CALL 1-877-579-5353 Our lump sum vs. From Life Retirement Planning To Investing Our Free Calculators Are Here To Help. Retirees Often Face a Tough Decision.

Ad Our Goal Is To Give You A More Logical Personal Way To Invest Manage Your Money. Ad The Pension-vs-Lump-Sum Decision Leaves Retirees With a Conundrum. Prepare For Your Future Today.

How is lump sum pension payout calculated. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Why Take a Lump Sum Pension Payout.

Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual retirement account. Calculation of tax relief on Eileens retirement lump sum Calculation Value. Find out what the required annual rate of return required would be for.

Learn More About Potential Lost Asset Growth Tax Consequences Penalties At TIAA. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. Ad Take Advantage Of Resources For Jackson-Appointed Financial Professionals.

This calculator will help you figure out how much income tax youll pay on a lump sum this tax year. The automatic standard lump sum is included when calculating the 25 total available to you. Ad Learn how a lump sum pension withdrawal may give you more income flexibility.

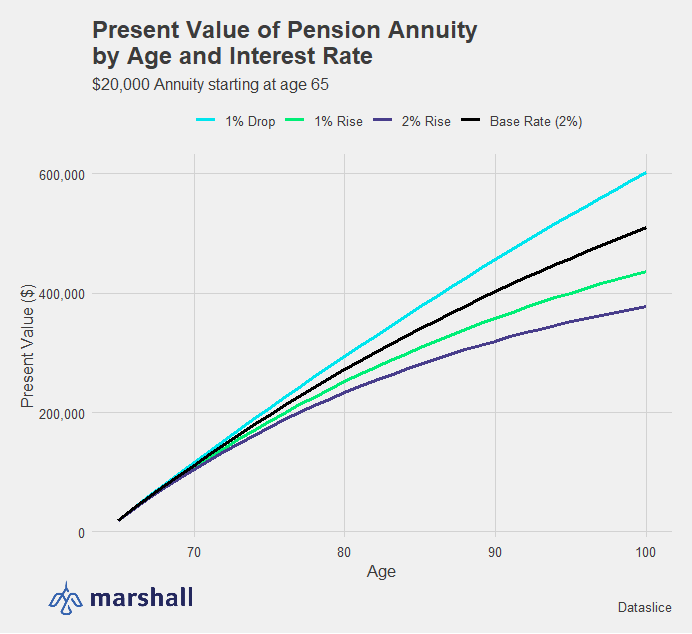

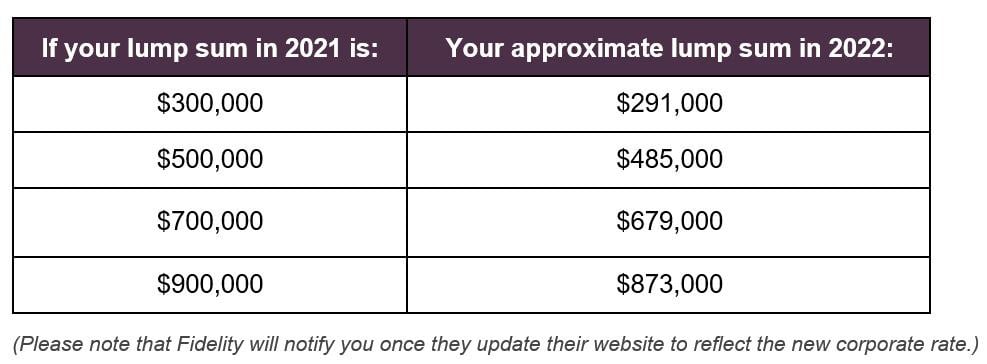

Everything else held equal a higher interest rate will produce a lower lump sum. Find out what the required annual rate of return required would be for. Should you consider a lump sum pension withdrawal for your 500K portfolio.

How to Avoid Taxes on a Lump Sum Pension Payout. Ad Estimate The Impact Of Taking An Early Withdrawal From Your Retirement Account. Lump Sum pension payout The lump sum that you would receive instead of guaranteed monthly pension.

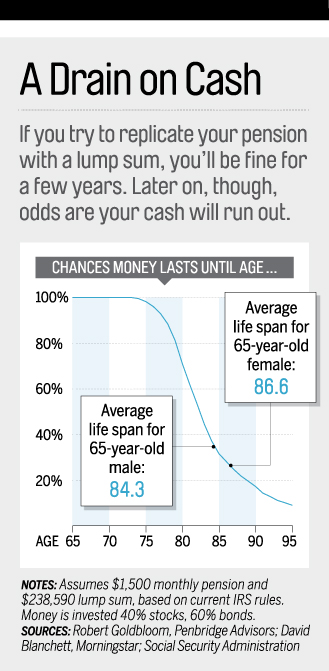

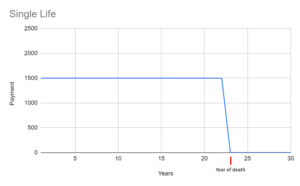

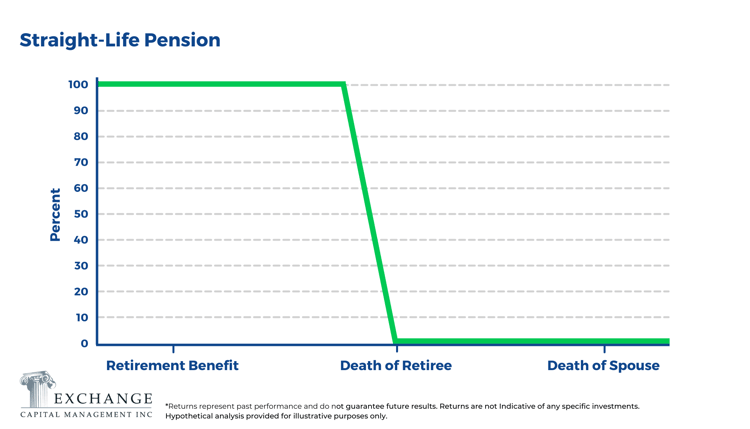

Work out what lump sum you need when you retire to produce a certain level of income. A simplified illustration. If you choose a lump-sum payout instead of monthly payments the responsibility for.

This is known as a lump-sum payout option. This is for taking it as an additional pension not the lump sum. Ad Find The Expertise Tools And Investments To Help Achieve Your Objectives.

Any spousal pension amount is calculated based on amount entered here. Find out what the required annual rate of return required would be for. Apply the 52 1045 to 5000 gives 7600 which is a better reflection of the.

Explore Tools Such As The Interactive Asset Location Tool Retirement Expense Calculator. The exact changes depend on your specific age but on average a 1 change in rates can equate to an 8. Annuity payment calculator compares two payment options.

Work out Tax Payable on Pension Provident and Retirement Annuity fund lump sums RETIREMENT FUND LUMP SUMS Use our fund benefit calculator to work out the tax payable. For example if you have a pension of 25200 and a standard lump sum of 75600 the lump sum. 19 November 2010 at 254PM.

If the rate used is 4 a pension benefit of 5000 monthly 60000 a year over 20 years would yield a lump sum of about 815419 Titus calculated. Lets say you decided to retire at 65 and you worked out you needed 80000. Employees often consider taking a lump sum pension payout for three common reasons.

You have access to the cash you. Start Today With Our Free Easy to Use Online Chat. The lump-sum grants you a huge amount of money immediately but it is still less than what you receive if you calculate all annuities After a 24 percent federal tax that amount.

A lump-sum distribution is the distribution or payment within a single tax year of a plan participants entire balance from all of the employers qualified plans of one kind for example. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. And The Right Choice May Not Be Obvious.

Calculate average annual pay for last three years. Receiving a lump sum. The mathematics of lump sums are a present value calculation meaning the lump sum is the present value of a stream of payments at an interest rate for a period of time.

Ad Get Personalized Action Items on What Your Financial Future Might Look Like.

Lump Sum Or Annuity Distributions What You Need To Know Rodgers Associates

Cracking The Code Choosing Between A Pension And Lump Sum

With Lifelong Payouts From The National Annuity Scheme Central Provident Fund Cpf Life We Need Not Worry About Outliving Our Savi How To Plan Life Life Plan

Personal Finance Lump Sum Or Monthly Annuity The Wealthadvisor Personal Finance Annuity Risk Free Investments

Personal Finance Lump Sum Or Monthly Annuity The Wealthadvisor Personal Finance Annuity Risk Free Investments

Tips For Making A Lump Sum Pension Payout Offer Cfo

Pension Take A Lump Sum Or Monthly Payout Money

How Do Pensions Work Your Ultimate Guide Paul Winkler Inc

Personal Finance Lump Sum Or Monthly Annuity The Wealthadvisor Personal Finance Annuity Risk Free Investments

The Lump Sum Social Security Payout Youtube

How To Prepare For Retirement In Your 20s Preparing For Retirement College Costs Retirement Planning

Which Is Better A Lump Sum Pension Payout Or Monthly Payments Marshall Financial Group

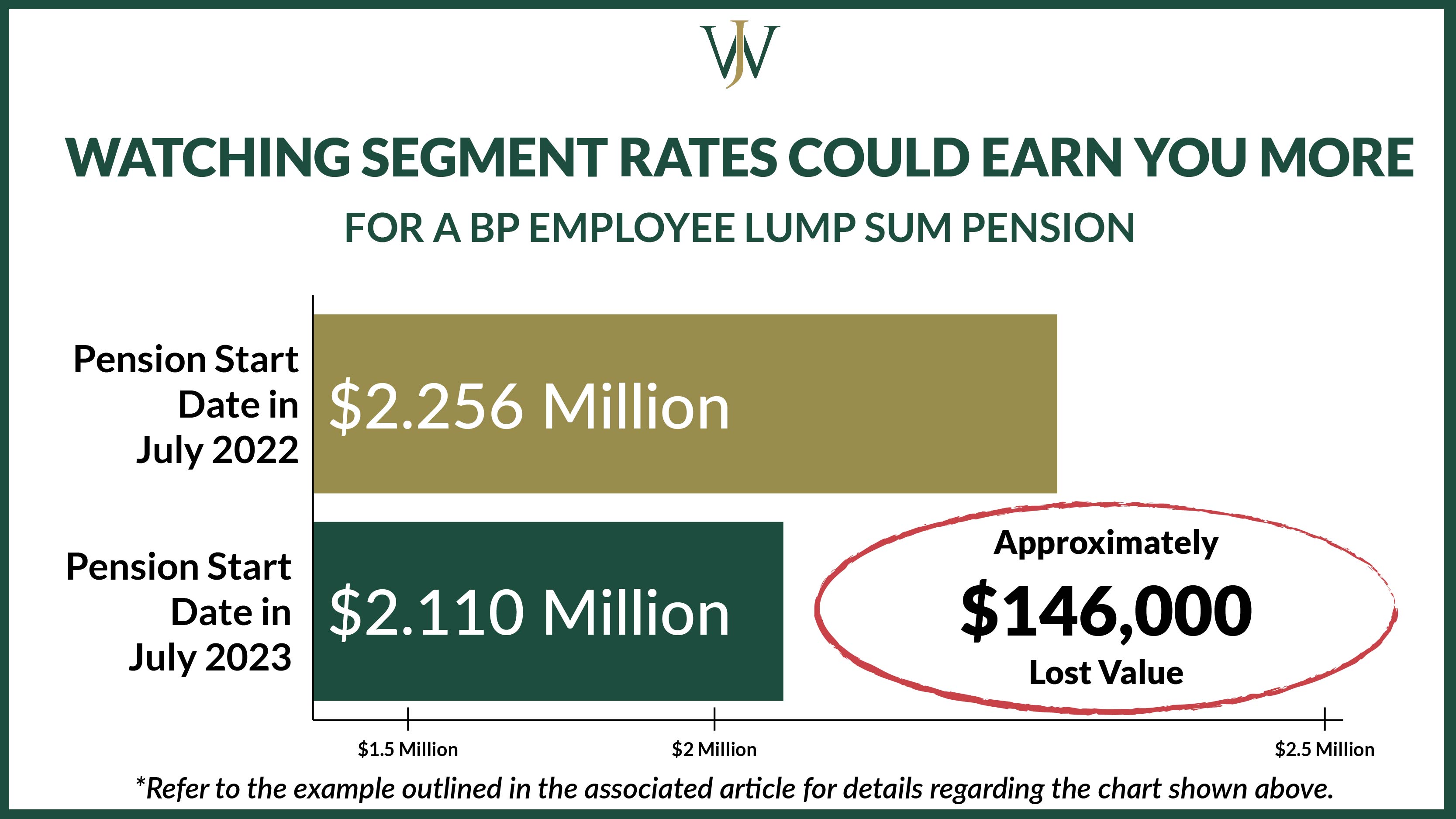

Why Optimizing Your Bp Pension Comes Down To Timing

Pension Lump Sum Payout Vs Monthly Annuity Keil Financial Partners

At T Pension Payouts Expected To Decrease In 2022

How To Pick Your Retirement Date To Optimize Your Chevron Pension

Lic S Delhi Jeevan Lakshya Table 833 Details Benefits Bonus Calculator Review Example Life Insurance Marketing Life Insurance Quotes Life And Health Insurance